Collateral—only relates to secured loans. Collateral refers to a little something pledged as protection for repayment of a loan in case the borrower defaults

60 Month Loans caters to borrowers who wouldn’t normally have access to a loan because of their credit rating scores. Dependant upon your credit profile, it may be the ideal firm. Nonetheless, check out its positives and negatives below before you decide to commit:

Take note that when you’re procuring around, it is possible to make an application for several vehicle loans in a brief time period — ordinarily 14 times, nevertheless it can vary by credit history scoring design — through which the affiliated really hard credit rating inquiries may well only depend as one hit.

You can find an desire level discount in the event you’re a Chase Non-public Customer, however this needs you to definitely possibly shell out a $35 regular provider payment, have an average daily harmony of at the least $150,000 in qualifying deposit and expense accounts, or link to an qualified business checking account.

Add a repayment get started date. This can be the date your initially payment is due. Quite a few lenders need the main payment 30 days following the loan is funded.

Enhance your deposit. Sellers need applicants to pay a particular amount toward a down payment.

60 Thirty day period Loans’ eligibility necessities could possibly be looser than many other lenders, but they’re also a tiny bit obscure. 60 Thirty day period Loans seems at two primary two things when examining your application: Your FICO Score (based on a smooth-credit history Check out) and 3 months’ value of bank statements.

Its automobile loans are offered for new or applied automobiles and automobile refinancing. It also provides them through the corporation’s vehicle-obtaining support, which can present you with a reduction in your amount.

Available to People with lousy credit: 60 Month Loans could approve you even When you've got much less-than-excellent credit rating.

We’ve rounded up financial institutions, credit rating unions and on the net lending platforms featuring a lot of the most effective commencing loan rates (as of Jan. 18, 2023) and various prospective Gains for various auto loan styles.

On the other hand, you are able to commonly obtain personal help by cell phone or simply in-individual if you select a lender with regular branches close to you.

While your month-to-month loan payment could possibly be lessen with a extended loan expression, Remember the fact that you’ll spend a lot more in curiosity in excess of the life of the loan, rising your whole here price of borrowing.

Unsecured loans commonly attribute larger desire costs, reduced borrowing restrictions, and shorter repayment phrases than secured loans. Lenders may in some cases demand a co-signer (a one that agrees to pay a borrower's credit card debt if they default) for unsecured loans If your lender deems the borrower as risky.

DCU can be a Massachusetts-based mostly nonprofit Business that offers a number of banking and lending products, together with car loans.

Amanda Bearse Then & Now!

Amanda Bearse Then & Now! Jeremy Miller Then & Now!

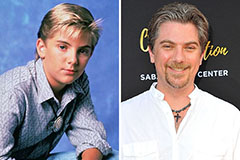

Jeremy Miller Then & Now! Robbie Rist Then & Now!

Robbie Rist Then & Now! Kane Then & Now!

Kane Then & Now! McKayla Maroney Then & Now!

McKayla Maroney Then & Now!